CRM for insurance companies has emerged as a transformative tool, revolutionizing the way insurers connect with their customers and drive business growth. By leveraging the power of technology, insurance companies can enhance customer service, streamline operations, and ultimately achieve greater success in today’s competitive market.

This comprehensive guide delves into the world of CRM for insurance companies, exploring its benefits, key considerations, best practices, and emerging trends. Discover how CRM can empower your insurance business to deliver exceptional customer experiences, optimize sales and revenue, and gain a competitive edge.

CRM Software Overview

CRM (Customer Relationship Management) software is a valuable tool for insurance companies looking to improve their customer interactions, streamline operations, and increase sales. It provides a centralized platform for managing customer data, tracking interactions, and automating processes.

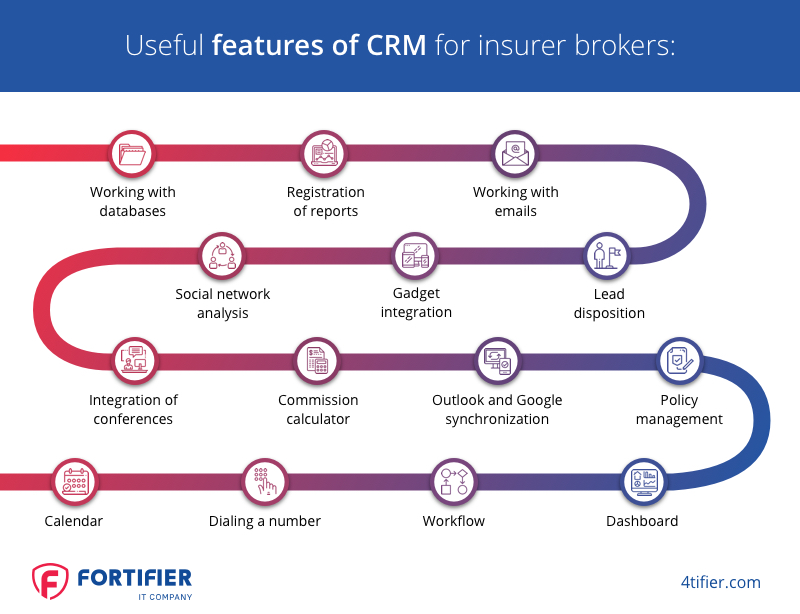

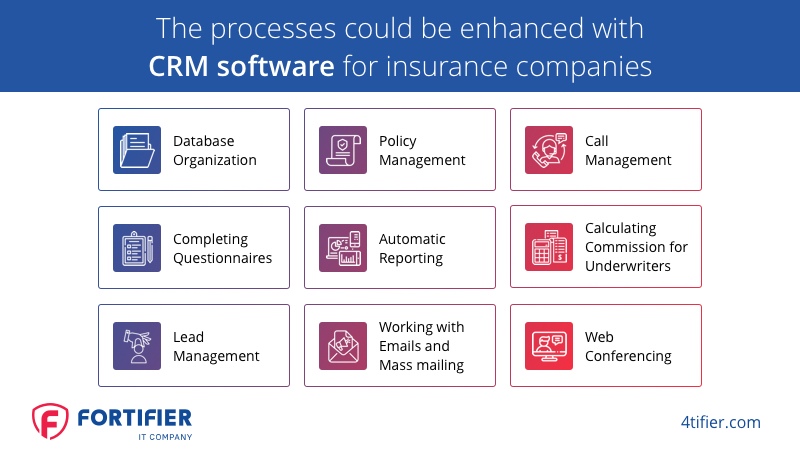

Key features and functionalities of CRM software for insurance companies include:

- Customer data management:Store and organize customer information, including contact details, policy information, and claims history.

- Lead management:Track and qualify leads, assign them to agents, and nurture them through the sales process.

- Sales automation:Automate tasks such as sending emails, scheduling appointments, and generating quotes.

- Policy management:Manage policies, track premiums, and process claims.

- Reporting and analytics:Generate reports on sales performance, customer satisfaction, and other key metrics.

There are different types of CRM systems available, including:

- On-premise CRM:Installed on the company’s own servers.

- Cloud-based CRM:Hosted by a third-party provider and accessed via the internet.

- SaaS (Software as a Service) CRM:A cloud-based CRM system that is typically subscription-based.

Key Considerations for Insurance CRM Selection

Choosing the right CRM system is crucial for insurance companies to enhance customer relationships, streamline operations, and drive growth. Here are some critical factors to consider when selecting a CRM system for your insurance business:

A comprehensive CRM system should offer essential features and capabilities that cater to the specific needs of insurance companies. These include:

Essential Features and Capabilities

- Policy Management:Track and manage policies, including policy details, premiums, and coverage information.

- Claims Processing:Automate claims processing, track claim status, and facilitate communication with policyholders.

- Agent Management:Manage agent profiles, track performance, and provide tools for lead generation and customer support.

- Customer Relationship Management:Capture and manage customer data, including demographics, policy information, and communication history.

- Reporting and Analytics:Generate reports and analyze data to track key performance indicators, identify trends, and make informed decisions.

Integration with Other Business Systems

Integration with other business systems is essential to ensure a seamless flow of information and eliminate data silos. Consider systems such as:

- Policy Administration Systems:Integrate with policy administration systems to access policy details and automate policy updates.

- Billing Systems:Integrate with billing systems to track premiums and payments, and generate invoices.

- Marketing Automation Platforms:Integrate with marketing automation platforms to nurture leads and automate marketing campaigns.

- Customer Service Platforms:Integrate with customer service platforms to provide a consistent customer experience across channels.

Implementation and Best Practices: Crm For Insurance Companies

To achieve a successful CRM implementation, follow these steps:

- Define clear goals and objectives:Determine the specific business outcomes you aim to achieve with CRM.

- Select the right CRM solution:Consider factors such as insurance industry-specific features, scalability, and ease of use.

- Plan and prepare for implementation:Establish a project team, define roles and responsibilities, and develop a communication plan.

- Data migration and integration:Import and integrate data from existing systems into the CRM, ensuring accuracy and completeness.

- User training and adoption:Provide comprehensive training to users and encourage adoption through regular support and communication.

- Monitor and evaluate performance:Track key metrics to assess CRM effectiveness and make adjustments as needed.

Best practices for data management and security include:

- Data governance:Establish policies and procedures for data ownership, access, and usage.

- Data security:Implement measures to protect sensitive customer information from unauthorized access or breaches.

- Data quality:Ensure data accuracy, consistency, and completeness through regular data cleansing and validation.

Strategies for user adoption and training include:

- User-centric approach:Tailor training to the specific needs and roles of different user groups.

- Hands-on training:Provide practical, hands-on experiences to enhance understanding and retention.

- Ongoing support:Offer continuous support and resources to users, addressing any questions or challenges.

Case Studies and Success Stories

Insurance companies that have successfully implemented CRM have reported significant benefits, including improved customer satisfaction, increased sales, and reduced operational costs. Here are a few real-world examples:

AXA Insurance:AXA implemented Salesforce CRM to improve customer service and streamline its sales process. The company saw a 20% increase in customer satisfaction scores and a 15% increase in sales revenue within the first year of implementation.

Progressive Insurance:Progressive Insurance implemented Oracle Siebel CRM to improve its claims processing efficiency. The company was able to reduce its claims processing time by 30% and improve customer satisfaction scores by 10%.

State Farm Insurance:State Farm Insurance implemented Microsoft Dynamics CRM to improve its customer relationship management across all channels. The company saw a 15% increase in customer retention and a 10% increase in sales revenue within the first two years of implementation.

Customer Testimonials

- “CRM has been a game-changer for our business. We’ve seen a significant improvement in customer satisfaction, sales, and operational efficiency.”

- “CRM has helped us to better understand our customers and their needs. This has enabled us to provide them with a more personalized and relevant experience.”

- “CRM has streamlined our sales process and made it easier for our sales team to close deals.”

Emerging Trends in Insurance CRM

The insurance industry is undergoing a digital transformation, and CRM is playing a key role in this process. Insurance companies are increasingly using CRM to improve customer service, increase sales, and reduce costs.Artificial intelligence (AI) and machine learning (ML) are two of the most important trends in CRM technology.

AI and ML can be used to automate tasks, improve decision-making, and provide personalized customer experiences.For example, AI can be used to:* Automate the process of underwriting insurance policies

- Identify and target potential customers

- Provide personalized customer service

- Detect and prevent fraud

ML can be used to:* Improve the accuracy of risk assessments

- Predict customer behavior

- Identify opportunities for cross-selling and up-selling

Integration with Other Technologies, Crm for insurance companies

CRM is also being integrated with other technologies, such as IoT and blockchain. This integration is creating new opportunities for insurance companies to improve customer service, increase sales, and reduce costs.For example, IoT can be used to:* Track the location of insured assets

- Monitor the condition of insured assets

- Detect and prevent fraud

Blockchain can be used to:* Securely store and share customer data

- Automate the process of claims processing

- Reduce the cost of insurance

Final Conclusion

In conclusion, CRM for insurance companies is an indispensable investment for insurers seeking to thrive in the modern business landscape. By embracing the capabilities of CRM technology, insurance companies can transform their operations, enhance customer satisfaction, and drive sustainable growth.

As the industry continues to evolve, CRM will remain a cornerstone for insurance companies seeking to stay ahead of the curve and deliver unparalleled customer experiences.

FAQ Overview

What are the key benefits of CRM for insurance companies?

CRM empowers insurance companies to improve customer service, increase sales and revenue, and gain operational efficiencies.

What are some essential features of a CRM system for insurance companies?

Key features include customer management, policy management, sales tracking, and integration with other business systems.

How can CRM help insurance companies improve customer service?

CRM provides a centralized platform for managing customer interactions, enabling insurers to deliver personalized and responsive service.